The key role of nickel

While the role of nickel in the chemical composition of lithium-ion batteries is still underestimated, however, CEO and co-founder of Tesla Elon Musk, who, like no one else, is familiar with the situation, has already stated the importance of this metal in terms of the introduction of electric vehicles.

Indeed, nickel by weight is the most important metal in the cathodes of lithium-ion batteries used by electric vehicle (EM) manufacturers.

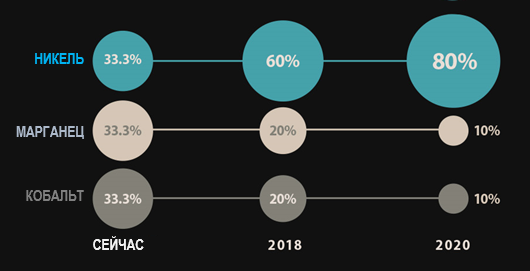

The proportion of nickel in various types of lithium-ion batteries

Already, this metal makes up about 80% of the cathodes of nickel-cadmium-aluminum (NCA) batteries installed on famous Tesla cars, and one third in the cathodes of nickel–manganese-cadmium (NMC) or lithium oxide-nickel-manganese-cadmium (LMO-NMC) batteries. Moreover, experts at UBS investment bank believe that in the coming years, the chemical composition of batteries will increasingly shift towards nickel.

For example, according to UBS, the composition of NMC cathodes used by General Electric in its Chevy Volt will change as follows:

The fact is that each new generation of NMC batteries uses more and more nickel. This gives an increase in specific energy consumption by about 20% – while reducing the total cost of raw materials and increasing the competitiveness of the production of each kW of battery capacity.

Thus, over time, nickel will account for 80% by weight of both RCA and NMC cathodes in batteries installed in Tesla and Chevrolet electric vehicles.

Impact on the nickel market

Today, nickel, mainly used for the production of stainless steel, represents one of the most important global metal markets with a size of more than 20 billion US dollars. And although batteries for EM account for only 3% of total nickel consumption, the further growth of the market for this metal is associated with the development of electric vehicles.

At the moment, EM accounts for only 1% of the total demand for cars in the world, which is equivalent to the demand for nickel of 70 thousand tons. However, as the share of EM increases, the demand for nickel will also increase very quickly.

Thus, Cairn Energy experts believe that an increase in the share of EM to 6% by 2025 will lead to an additional demand for nickel of 97 thousand tons. According to Glencore CEO Ivan Glasenberg, by the time EM occupies 10% of the automotive market, 400 thousand tons of nickel will be needed to produce their fuel cells. And according to UBS analysts, in the event of a complete transition to electric vehicles, global demand for this metal will more than double and reach 2.2 million tons.

And I must say that such forecasts can be realized faster than it seems at first glance. Already, many large countries have set a goal to stop sales of vehicles powered by gas and diesel fuel. The UK and France want to ban the sale of cars using fossil fuels by 2040, in Norway all new passenger cars and buses should be environmentally friendly (with zero emissions) by 2025, India intends to completely transfer its citizens to electric vehicles by 2030. China, the country with the largest automotive market in the world, is also preparing to completely ban gas–powered vehicles as part of the fight against air pollution.

An unexpected turn on the supply side

So, if electric cars are really our future, then there will be significant changes in the nickel market: its size will increase at least twice. Another question is where will we get all this nickel?

The fact is that most of the nickel produced at the moment is unsuitable for the production of batteries. Let's explain: two types of deposits are being developed in the world, which are very different from each other:

62.4% of global production is accounted for by laterite deposits containing large volumes of low-quality, or so-called "dirty" nickel. They are mainly concentrated in Indonesia, Cuba, the Philippines and New Caledonia.

The remaining 37.2% are sulfide deposits, where high–quality, or "pure" nickel is mined. These deposits are much rarer and are located mainly in North America, Australia, China, Russia and Greenland.

Laterite deposits are used for the production of ingot nickel and ferronickel, which are cheap raw materials for the production of Chinese stainless steel, while sulfide deposits are involved in the production of metallic nickel and nickel sulfate. Nickel sulfate is a crystalline nickel sulfate, which is mainly used for electroplating and as a material for the production of lithium-ion cathodes. At the same time, less than 10% of the global nickel supply is now represented in the form of sulfate, and it is not all suitable for use in batteries in terms of quality.

It is not surprising that large mining companies see the electric car revolution as a good opportunity to launch new nickel projects. In August 2017, industry giant BHP Billiton announced an investment of $43.2 million in the construction of the world's largest nickel sulfate plant in Australia.

However, according to experts from the consulting company Wood Mackenzie, even such investments may not be enough to keep up with the growing demand for nickel sulfate from manufacturers of lithium-ion batteries for electric vehicles.

«...Our fuel cells should be called nickel-graphite, since the cathode part is mainly made of nickel, and the anode part is made of graphite with silicon oxide."

Elon Musk, CEO of SpaceX,

Chairman of the Board of Directors of Tesla, member of the Board of Directors of SolarCity

«...The shift of only 10% of the global car fleet towards EM will create a demand for nickel of 400 thousand tons. Glencore sees a shortage of nickel with increasing demand for EM."

Ivan Glasenberg, Glencore CEO

"The demand for lithium-ion batteries is growing at a tremendous pace, the role of nickel in lithium-ion batteries is very large, and its content is increasing as it increases energy density and energy intensity."

Eddie Hangel, President of BHP Nickel